Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

Table of ContentsMileagewise - Reconstructing Mileage Logs for DummiesThe Greatest Guide To Mileagewise - Reconstructing Mileage LogsSome Ideas on Mileagewise - Reconstructing Mileage Logs You Should KnowWhat Does Mileagewise - Reconstructing Mileage Logs Mean?The Definitive Guide to Mileagewise - Reconstructing Mileage LogsFacts About Mileagewise - Reconstructing Mileage Logs UncoveredAn Unbiased View of Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Range function recommends the shortest driving route to your staff members' location. This feature enhances performance and adds to cost savings, making it an essential asset for services with a mobile workforce.Such a method to reporting and compliance streamlines the often complex task of handling gas mileage expenses. There are several advantages connected with utilizing Timeero to track gas mileage. Let's take an appearance at some of the app's most notable attributes. With a relied on mileage tracking tool, like Timeero there is no requirement to stress concerning mistakenly omitting a date or item of information on timesheets when tax obligation time comes.

7 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

With these tools in operation, there will be no under-the-radar detours to raise your reimbursement prices. Timestamps can be located on each gas mileage entry, increasing integrity. These extra verification steps will maintain the internal revenue service from having a factor to object your gas mileage documents. With accurate gas mileage monitoring innovation, your employees don't have to make harsh gas mileage quotes or perhaps fret about mileage expenditure monitoring.

If an employee drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all vehicle expenses (simple mileage log). You will need to proceed tracking gas mileage for job even if you're making use of the real expense approach. Maintaining gas mileage documents is the only means to different business and personal miles and give the proof to the IRS

Most mileage trackers allow you log your trips manually while determining the distance and reimbursement amounts for you. Numerous additionally come with real-time journey monitoring - you need to begin the application at the beginning of your trip and quit it when you reach your final location. These apps log your begin and end addresses, and time stamps, along with the overall range and reimbursement quantity.

Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

This includes prices such as gas, maintenance, insurance policy, and the automobile's depreciation. For these expenses to be taken into consideration deductible, the lorry must be utilized for business purposes.

How Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

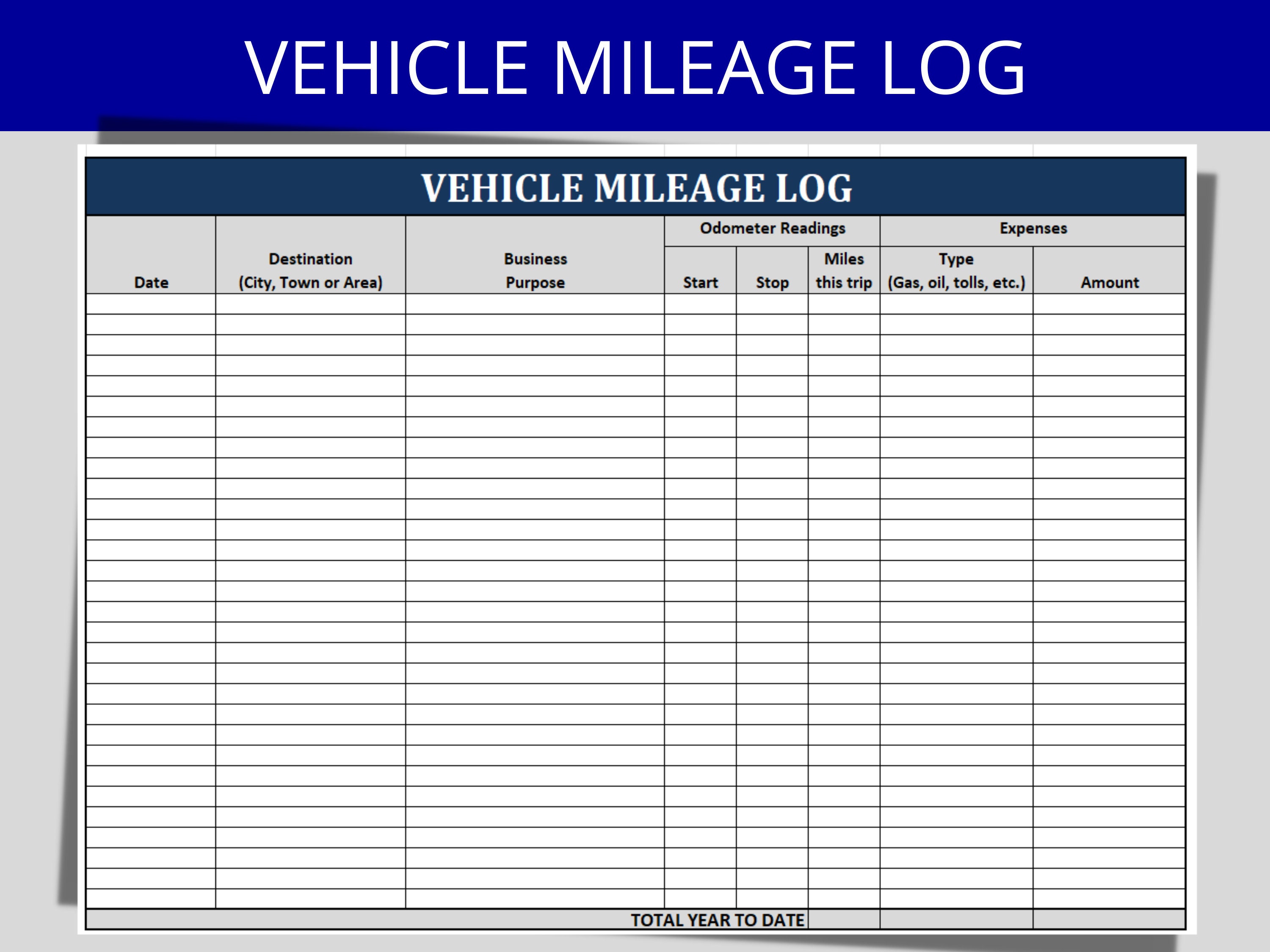

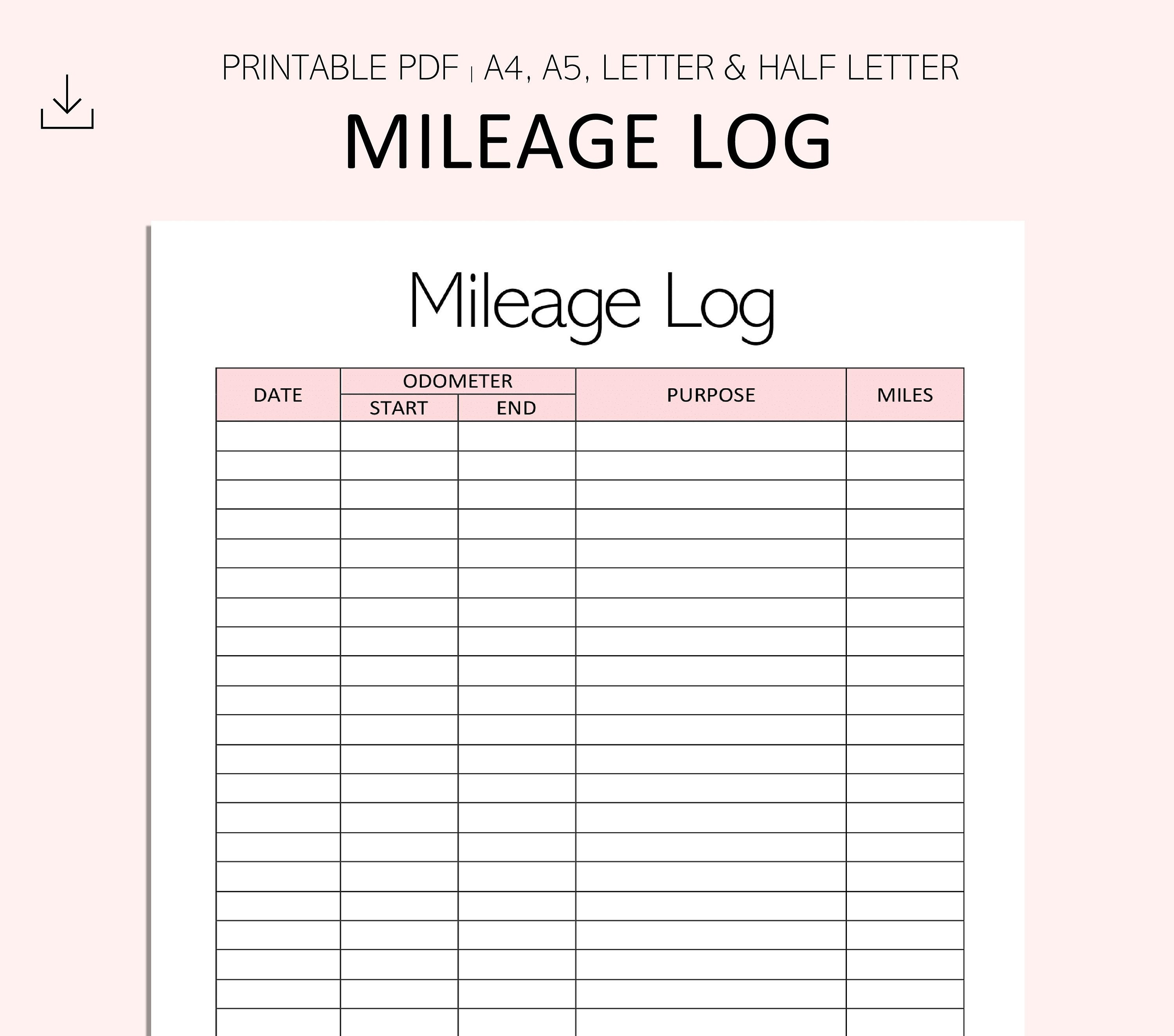

In in between, vigilantly track all your business journeys noting down the beginning and ending analyses. For each journey, record the area and service objective.

This includes the complete company gas mileage and total mileage buildup for the year (company + individual), trip's day, destination, and purpose. It's necessary to tape-record tasks immediately and keep a contemporaneous driving log describing date, miles driven, and service objective. Here's just how you can improve record-keeping for audit objectives: Beginning with ensuring a meticulous gas mileage log for all business-related traveling.

The Greatest Guide To Mileagewise - Reconstructing Mileage Logs

The actual costs method is an alternate to the basic gas mileage price method. Rather of computing your reduction based on an established rate per mile, the real costs technique permits you to deduct the actual prices connected with using your lorry for company purposes - free mileage tracker. These prices include fuel, maintenance, repair services, insurance, devaluation, and various other related expenses

Those with significant vehicle-related costs or one-of-a-kind conditions may benefit from the real expenditures technique. Please note electing S-corp condition can change this estimation. Eventually, your chosen approach ought to straighten with your certain financial objectives and tax scenario. The Requirement Mileage Rate is a measure issued every year by the internal revenue service to determine the deductible expenses of running a vehicle for business.

The 15-Second Trick For Mileagewise - Reconstructing Mileage Logs

(https://anotepad.com/notes/nfgjwnhd)Whenever you use your cars and truck for company trips, videotape the miles took a trip. At the end of the year, again write the odometer analysis. Compute your overall organization miles by utilizing your start and end odometer analyses, and your videotaped organization miles. Properly tracking your precise gas mileage for service trips help in validating your tax obligation deduction, specifically if you select the Requirement Mileage technique.

Tracking your gas mileage by hand can need persistance, but bear in mind, it could save you cash on your tax obligations. Comply with these actions: List the date of each drive. Videotape the total mileage driven. Think about noting your odometer analyses before and after each trip. Write down the beginning and ending points for your journey.

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline company sector ended up being the very first industrial users of GPS. By the 2000s, the shipping sector had adopted GPS to track packages. And currently virtually everybody utilizes GPS to get about. That indicates almost everybody can be tracked as they set about their company. And there's the rub.